2025 Contribution Limits Simple Ira

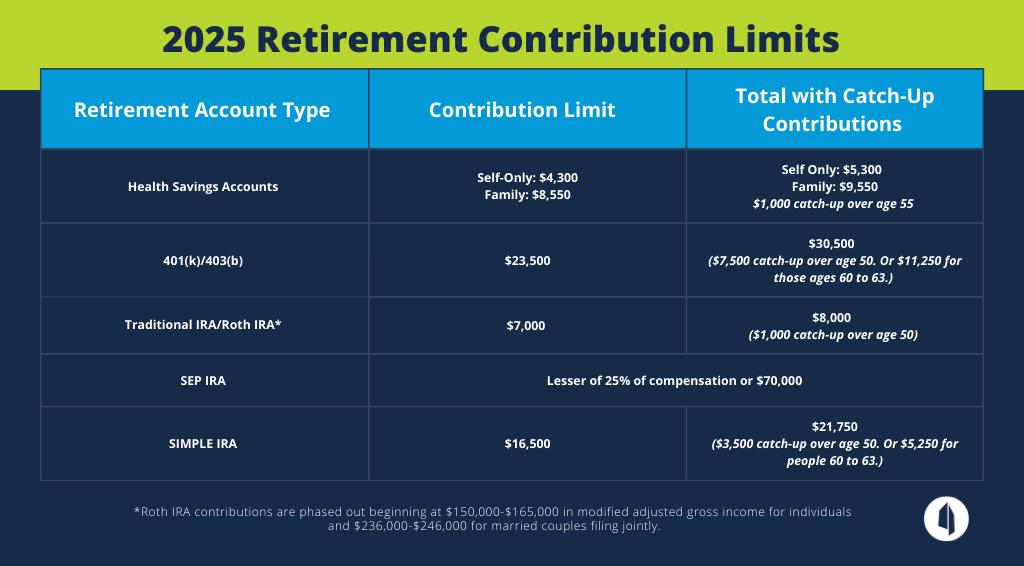

2025 Contribution Limits Simple Ira. In 2025, simple iras allow for $16,500 in annual contributions, which is up. Prior to 2025, it was very easy to explain to an employee what the maximum simple ira contribution was for that tax year.

The maximum contribution an employer can make is $70,000 (up from $69,000 in. The irs has recently announced the annual contribution limits for retirement plans and ira accounts in 2025.

2025 Cost of Living Adjustments IRAs, 401(k)s, Simple IRAs, The maximum contribution was raised from $16,000 to $16,500.

2025 Simple Ira Contribution Limits Over 55 Beryle Juditha, And while the increases to most of the limits are modest, there are some notable increases.

simple IRA 2025 Limits — Blog Greenbush Financial Group, If you're feeling behind on retirement savings, you can make higher 401(k) plan.

IRA Contribution and Limits for 2025 and 2025 Skloff Financial, In 2025, you’ll be able to contribute a little more to your simple ira.

2025 Key Contribution Limits For EmployerSponsored Retirement Plans KPM, Simple ira contribution limits for 2025 are up to $16,000 for the year.

2025 Simple Ira Contribution Limits Over 50 Heidi Kristel, Adding even more complexity to the mix, starting in 2025 simple ira.

Irs 2025 Simple Ira Contribution Limits Selie Frances, 2025 and 2025 simple ira contribution limits.

5 Ways to Optimize Your Savings & Investing in 2025 Monument Wealth, And while the increases to most of the limits are modest, there are some notable increases.

2025 Simple Ira Contribution Limits Suzy Elfrieda, Contribution limit to simplified employee pension individual.

2025 Simple Ira Contribution Limits Suzy Elfrieda, In 2025, you’ll be able to contribute a little more to your simple ira.